The Insurance Technology Gap

Disconnected workflows, manual processes, and legacy tools are creating bottlenecks in insurance growth and efficiency.

System Fragmentation

70% of insurers operate on disjointed tools that block real-time data flow.

70%Operational Inefficiency

40% of processing time is lost to system switching and manual data re-entry.

40%Revenue Leakage

Over $8B annually lost to failed tech integrations and process inefficiencies.

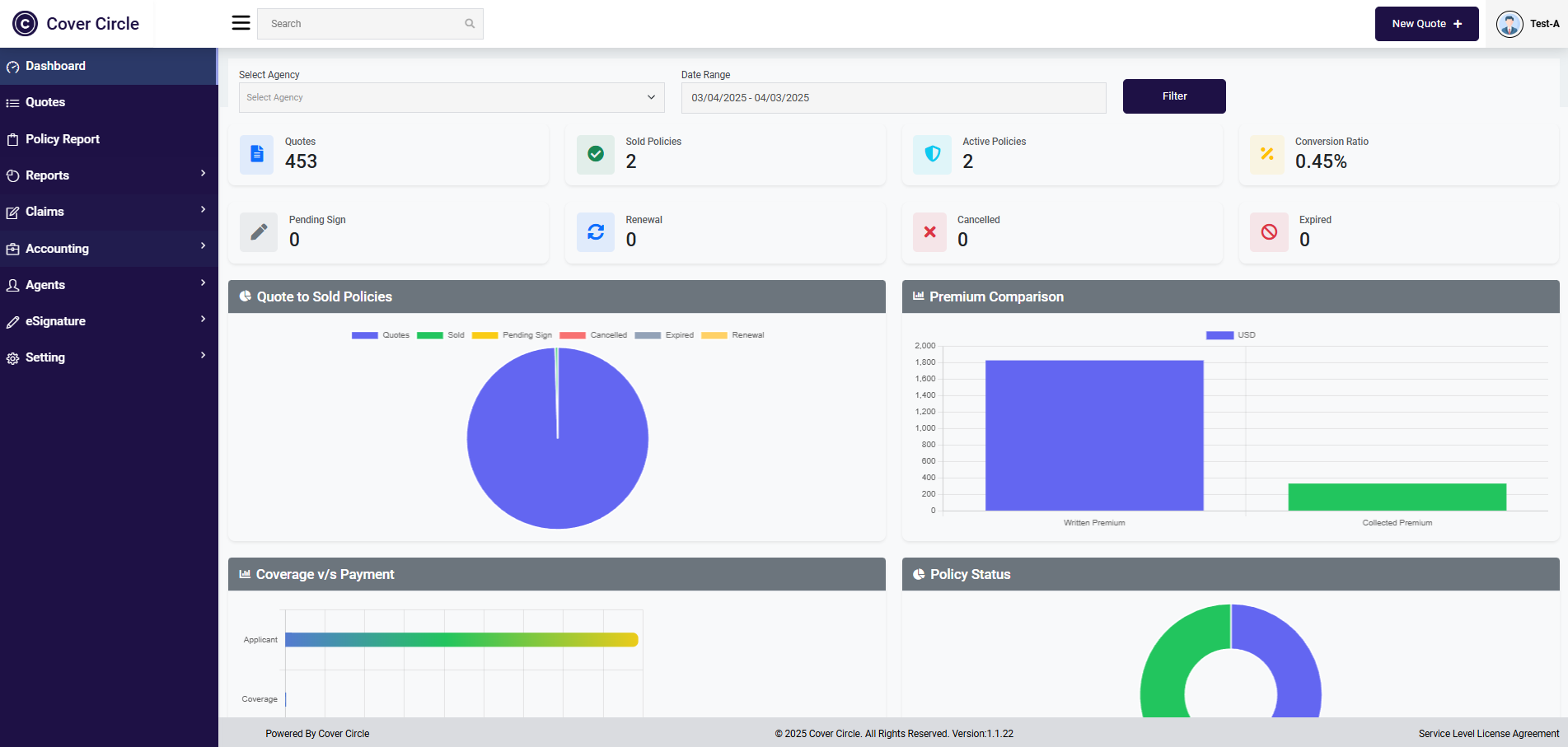

$8B+Transform Insurance Operations with Digital Workflows

Our intelligent platform bridges the gap between carriers and agencies through seamless automation and integration.

Multi-Channel Distribution

Direct integration with 300+ independent agencies and national aggregators

Unified Quoting Engine

All quoting and servicing tools in one platform with API integrations

Automated Fund Management

Real-time splitting between agencies, carriers, and third-party services

AI-Powered Intelligence

- Smart lookup for instant policy recommendations

- Advanced fraud detection algorithms

- Automated payment reminders and renewals

- Predictive analytics for risk assessment

Integration Setup

Custom branding and configuration

Rate & Rules

Underwriting and pricing setup

Agent Onboarding

Connect your distribution network

Quote & Bind

Embedded digital capabilities

Agency Management

Policy tracking and reporting

Claims & Reporting

Third-party integration support

Our Insurance Technology Products

Innovative platforms designed to modernize insurance operations for agencies and carriers.

Ready to Transform Your Insurance Operations?

Our team of experts is ready to guide you through our platform's capabilities.